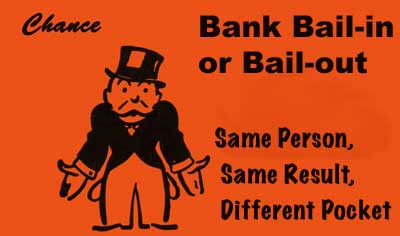

Banking expert Ellen Brown warns that people are more at risk in the U.S. to lose their savings because the five biggest banks have nearly $250 trillion in derivatives. In a financial calamity that could cause mass bankruptcies, recent legislation says the derivative holders will be paid first. Brown explains, “The derivatives have super priority over everything. . . . All the creditors’ money will be taken in a bail-in. A bail-in is the opposite of a bankruptcy. In a bankruptcy, the bank is liquidated in order to pay off the creditors. In a bail-in, the creditors’ money is taken in order to keep the bank alive. So, we get to die while the bank lives instead of the reverse. They specifically say ‘creditors’ which means shareholders and bond holders, but what most people don’t realize is depositors are also considered creditors. When you put your money in a bank, it becomes the property of the bank, and all you have is an IOU.”

Watch Ellen's interview below.

https://www.youtube.com/watch?v=2oehMznZd7w

If you have a bank account anywhere in Europe, you need to read this

article. On January 1st, 2016, a new bail-in system went into effect

for all European banks.

This new system is based on the Cyprus bank bail-ins that we witnessed a

few years ago.

Money was grabbed from anyone that had more than

100,000 euros in their bank accounts in order to bail out the banks. Now

the exact same principles that were used in Cyprus are going to apply to all of

Europe.

And with the entire global financial system teetering on the brink of

chaos, that is not good news for those that have large amounts of money stashed

in shaky European banks.

The announcement about this new bail-in system

that comes directly from the official website of the European Parliament.

I want you to notice that they explicitly say that "unsecured

depositors would be affected last". What they really mean is that

any time a bank in Europe fails, they are going to come after private bank

accounts once the shareholders and bond holders have been wiped out.

So if you have more than 100,000 euros in a European bank right now, you

are potentially on the hook when that bank goes under.

"The directive establishes a bail-in system which will ensure that

taxpayers will be last in the line to the pay the bills of a struggling

bank.

In a bail-in, creditors, according to a pre-defined hierarchy, forfeit

some or all of their holdings to keep the bank alive.

The bail-in tool set out in the directive would require shareholders and

bond holders to take the first big hits.

Unsecured depositors (over 100,000 euro) would be affected last, in many

cases even after the bank-financed resolution fund and the national deposit

guarantee fund in the country where it is located have stepped in to help

stabilize the bank.

Smaller depositors would in any case be explicitly excluded from any

bail-in."

And as we have seen in the past, these rules can change overnight in the

midst of a major crisis.

So they may be promising that those with under 100,000 euros will be safe

right now, but that doesn't necessarily mean that it will be true.

It is also important to note that there has been a really big hurry to get

all of this in place by January 1. In fact, at the end of October the

European Commission actually sued six nations that had not yet passed

legislation adopting the new bail-in rules&

"The European Commission is taking legal action against member states

including the Netherlands and Luxembourg, after they failed to implement rules

protecting European taxpayers from funding billions in bank rescues.

Six countries will be referred to the European Court of Justice (ECJ) for their continued failure to transpose the EUs bail-in laws into national legislation, the European Commission said on Thursday."

So why was the European Commission in such a rush?

Is there some particular reason why January 1 is so important?

This is something that I will be watching.

Meanwhile, there have been major changes in the U.S. as well. The

Federal Reserve recently adopted a new rule that limits what it can do to bail

out the "too big to fail" banks.

"The Federal Reserve is cutting its lifeline to big banks in

financial trouble.

The Fed officially adopted a new rule Monday that limits its ability to

lend emergency money to banks.

In theory, the new rule should quash the notion that Wall Street banks are

"too big to fail."

If this new rule had been in effect during the last financial crisis, the

Federal Reserve would not have been able to bail out AIG or Bear Stearns.

As a result, the final outcome of the last crisis may have been far

different."

Under the new rule, banks that are going bankrupt or appear to be

going bankrupt can no longer receive emergency funds from the Fed under

any circumstances.

If the rule had been in place during the financial crisis, it would have

prevented the Fed from lending to insurance giant AIG (AIG) and Bear Stearns,

Fed chair Janet Yellen points out.

So if the Federal Reserve does not bail out these big financial

institutions during the next crisis, what is going to happen?

Will we see European-style "bail-ins" when large banks start

failing?

And exactly what would such a "bail-in" look like?

Essentially, what happens is that wealth is transferred from the

"stakeholders" in the bank to the bank itself in order to keep it

solvent. That means that creditors and shareholders could potentially

lose everything if a major bank in Europe fails.

And if their "contributions" are not enough to save the bank,

those holding private bank accounts will have to take haircuts just like

we saw in Cyprus.

In fact, the travesty that we witnessed in Cyprus is being used as a

template for much of the new legislation that is being enacted all over

Europe.

Many Americans assume that when they put money in the bank that they have

a right to go back and get their money whenever they want. That is no longer true. If we

all went to the bank at the same time, there wouldn't be nearly enough money for

all of us.

The reason for this is that the banks only keep a small fraction of our

money on hand to satisfy the demands of those that conduct withdrawals on a day

to day basis. The banks take the rest of the money that we have deposited

and use it however they think is best.

If you have money at a bank that goes under, that bank will still be

obligated to pay you back, but it may not be able to do so.

This is where the FDIC comes in. The FDIC supposedly guarantees the

safety of deposits in member banks, but at any given time it only has a very,

very small amount of money on hand.

If some major crisis comes along that causes banks all over the United

States to start falling like dominoes, the FDIC will be in panic mode.

During such a scenario, the FDIC would be forced to ask Congress for a

massive amount of money, and since we already run a giant deficit every year

the government would have to borrow whatever funds would be required.

I find it very interesting that we have seen major rule changes

in Europe and at the Federal Reserve just as we are entering a new global

financial crisis.

Do they know something that the rest of us do not?

Be very careful with your money, because I am convinced that "bank

bail-ins" will soon be making front page headlines all over the world and remember you are not a depositor but a creditor!

No comments:

Post a Comment