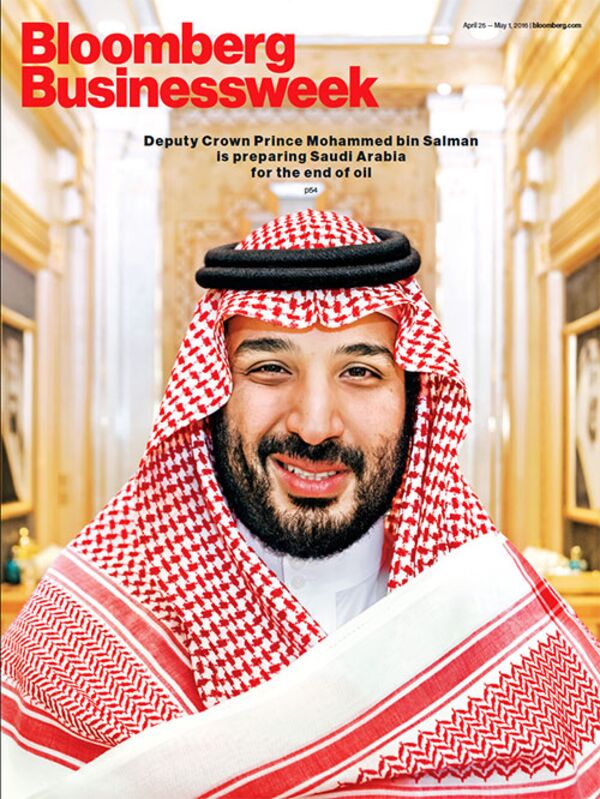

The Saudi

“anti-corruption” crackdown led by Crown Prince Mohammed bin Salman (MbS), pictured below, which initially netted

11 princes and a few dozen ministers and former ministers, has caught up with

hundreds of businessmen, who are being detained in the luxurious Ritz Carlton

and other hotels in Riyadh. MbS

is targeting an astonishing $800 BILLION in assets believed to be held in 1,700

frozen bank accounts.

Your Watchman believes MbS will top off his coup by

having himself crowned King. Al-Arabiya, the

Saudi-owned pan-Arab television news channel, posted on Twitter on

November 8th that the abdication may be imminent but then deleted the

post. How will this play out further?

Not even the key players probably know. But it is entirely possible – in the midst of feuding in

the royal family – that the entire Saudi Monarchy could be overthrown and

replaced by a military junta much as happened in Egypt in 1952, when King Faruq

was overthrown and replaced by military leaders Muhammad Naguib and Gamal Abdel

Nasser pictured above.

Saudi authorities have questioned 208 people in an “anti-corruption”

investigation and estimate

at least $100 billion has been stolen through graft, a top official said

on Thursday as the inquiry expanded beyond the kingdom’s borders.

“Based

on our investigations over the past three years, we estimate that at least $100

billion has been misused through systematic corruption and embezzlement over

several decades,” Attorney-General Sheikh Saud al-Mojeb said in a statement.

Anti-corruption authorities

have also frozen the bank accounts of CIA backed, Prince Mohammed bin Nayef,

one of the most senior members of the House of Saud, and some of his immediate

family members. Nayef had been appointed as Crown Prince in 2015 and was first

in line to the throne until he was replaced by MBS in June. He is a nephew of

King Salman and grandson of the founding monarch King Abdulaziz.

The investigation has spread to the neighboring United Arab

Emirates, as the UAE

central bank has asked commercial banks and finance companies there to provide

details of the accounts of 19 Saudis.

The UAE, particularly Dubai, is one of the main places where

wealthy Saudis park their money abroad.

In addition to bank accounts, they buy luxury apartments and villas in Dubai

and invest in the emirate’s volatile stock market.

Some wealthy Saudi individuals have

been liquidating assets within Saudi Arabia, the UAE and

other Gulf countries this week, apparently in an effort to move money out of

the region and escape the crackdown, private bankers and fund managers said.

In Riyadh, rich individual investors have been selling equities

heavily, although buying by state-linked funds has helped to support the

market. In Dubai, shares in real estate developers have sunk as investors worry

about the impact on the property market of a pull-out by Saudis.

The UAE commercial bankers said they had not been asked to

freeze the Saudi accounts at their

institutions, but they believed the central bank’s request for information

might be a prelude to such action.

The risk of the accounts being frozen “jeopardizes Dubai’s pitch

as a private banking center”, said a Gulf-based banker, adding: “Banks in the

UAE are full of Saudi money.”

One senior banker at an international bank with business in Saudi Arabia

said his institution had already frozen some accounts, both inside the kingdom

and outside it, in response to Saudi government requests.

The

bank is conducting its own investigations into accounts linked to people who

have been detained, the banker said without elaborating.

Another banker in the region said his institution was receiving

more inquiries from Saudi clients about

cross-border financial transactions, but it was handling the inquiries with

extreme caution as there could be further action by regulators.

No comments:

Post a Comment