Below are some bullet points from the video that we need to consider:

1.

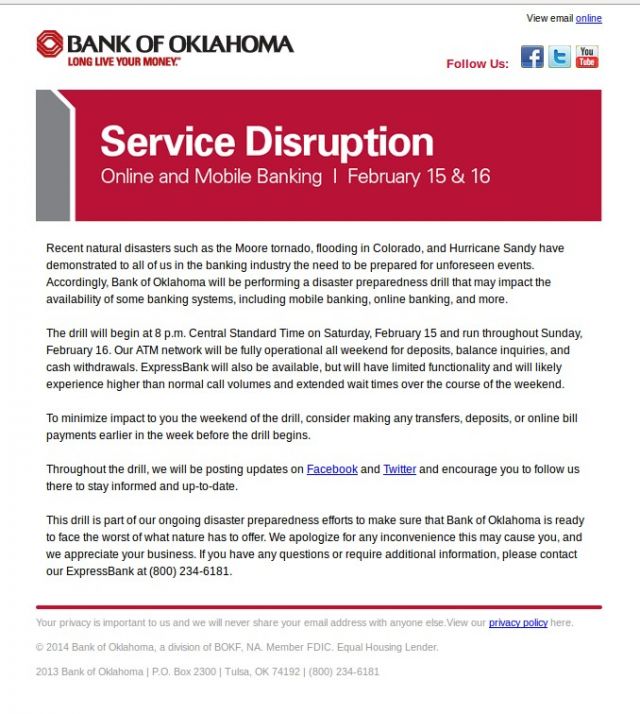

Drills are conducted on the same day at

the same location as “alleged” terrorist attacks e.g. 9/11 and the Boston

Marathon.

2.

Why are “Swift” and New Zealand involved

in a U.S. Bank Drill?

3.

We will have no electronic access to our

bank accounts

4.

Could this be a test like the one in

Greece that shut down Greece’s banking system?

5.

A culprit has been found and blame is already

in place. The bad guys will be the “Syrian Electronic Army”; this provides the

scapegoat that the United States wants to go to war with: Assad in Syria, this

could be Obama’s Tonkin Gulf incident.

6.

The drill begins on Saturday the 15th in

the afternoon and ends sometime on 16 Feb.

7.

Make sure you have cash on hand in the

event of this emergency.

Below is the video concerning the 15-16 bank drill.

Below is the video concerning the 15-16 bank drill.

http://www.youtube.com/watch?v=Loygt6XWVu8&sns=em

This is causing currencies to collapse and interest rates to soar all over the globe. Argentina, Turkey, South Africa, Ukraine, Chile, Indonesia, Venezuela, India, Brazil, Taiwan and Malaysia are just some of the emerging markets that have been hit hard so far. Just last week, emerging market currencies experienced their worst declines since the financial crisis of 2008, and the chaos overseas is beginning to spook Wall Street as well.

If the Federal Reserve opts to taper even more in the coming days, this currency crisis could rapidly turn into a complete and total currency collapse.

A lot of Americans have always assumed that the U.S. dollar would be the first currency to collapse when the next great financial crisis happens. But actually, right now just the opposite is happening.

Here’s a snapshot of what’s going on in Turkey, according to a recent report in the New York Times:

Turkey’s currency fell to a record low, a drop that will hit the purchasing power of everyone in the country. On a street corner in Istanbul, Yilmaz Gok, 51, said, “I’m a retiree making ends meet on a small pension and all I care about is a possible increase in prices. “I will need to cut further,” he said. “Maybe I should use my natural gas heater less.”

Inflation hurts those with low incomes far worse than it harms the rich. As prices rise relentlessly, the poor feel the pinch, having to cut back on basic necessities, because there is simply nothing else to cut. And this is not happening in just one or two countries. It is a truly global phenomenon, as demonstrated by the following observation:

Emerging markets are the future growth engine of the global economy and an important source of profits for U.S. companies. These developing economies were both recipients and beneficiaries of massive cash inflows the past few years as investors sought out bigger returns fostered by injections of cheap cash from the Federal Reserve and other central bankers.

But now that the Fed has started to dial back its stimulus, many investors are yanking their cash out of emerging markets and bringing the cash back to more stable markets and economies, such as the U.S., hurting the developing nations in the process, explains Russ Koesterich, chief investment strategist at BlackRock.

"Emerging markets need the hot money but capital is exiting now," says Koesterich. "What you have is people saying, 'I don't want to own emerging markets.'"

Here’s another example. Most Americans cannot even find Liberia on a map, but right now the actions of our Federal Reserve have pushed the currency of that small nation to the very edge of collapse:

Liberia's finance minister warned against panic today after being summoned to parliament to explain a crash in the value of Liberia's currency against the US dollar.

"Let's be careful about what we say about the economy. Inflation, ladies and gentlemen, is not out of control," Amara Konneh told lawmakers, while adding that the government was "concerned" about the trend.

Closer to home, the Mexican peso has likewise been impacted.

We’ve seen this before. Here are the likely impacts on these emerging market nations if this continues:

• Looting

• Violence

• Blackouts

• Shortages of basic supplies

• Runs on the banks

Hopefully something can be done to stop this from happening. But once a bubble starts to burst, it is really difficult to try to hold it together.

And while all this is happening, what are the big movers and shakers doing?

In the last month we saw the largest withdrawal from JP Morgan's gold vault ever recorded.

What does that say to you? To me, it seems that this is a harbinger of things to come. 2014 is shaping up to be a very volatile year. I hope that you are ready for what is coming next.

Friends, once again the

Illuminati and its int’l banksters are moving to de-stabilize Turkey, Liberia

and other countries. Why, all for the sake of division and greater profit for

the Satanists.

Remember all the

money that the Fed has been pumping into the US economy? Well, it turns out

that a big chunk of it (amounts totaling in the trillions of dollars) has

flowed into emerging markets. And now that the Fed has decided to begin to

taper off the flow of those funds, investors are responding by pulling the

"hot money" out of emerging markets as rapidly as possible.

This is causing currencies to collapse and interest rates to soar all over the globe. Argentina, Turkey, South Africa, Ukraine, Chile, Indonesia, Venezuela, India, Brazil, Taiwan and Malaysia are just some of the emerging markets that have been hit hard so far. Just last week, emerging market currencies experienced their worst declines since the financial crisis of 2008, and the chaos overseas is beginning to spook Wall Street as well.

If the Federal Reserve opts to taper even more in the coming days, this currency crisis could rapidly turn into a complete and total currency collapse.

A lot of Americans have always assumed that the U.S. dollar would be the first currency to collapse when the next great financial crisis happens. But actually, right now just the opposite is happening.

Here’s a snapshot of what’s going on in Turkey, according to a recent report in the New York Times:

Turkey’s currency fell to a record low, a drop that will hit the purchasing power of everyone in the country. On a street corner in Istanbul, Yilmaz Gok, 51, said, “I’m a retiree making ends meet on a small pension and all I care about is a possible increase in prices. “I will need to cut further,” he said. “Maybe I should use my natural gas heater less.”

Inflation hurts those with low incomes far worse than it harms the rich. As prices rise relentlessly, the poor feel the pinch, having to cut back on basic necessities, because there is simply nothing else to cut. And this is not happening in just one or two countries. It is a truly global phenomenon, as demonstrated by the following observation:

Emerging markets are the future growth engine of the global economy and an important source of profits for U.S. companies. These developing economies were both recipients and beneficiaries of massive cash inflows the past few years as investors sought out bigger returns fostered by injections of cheap cash from the Federal Reserve and other central bankers.

But now that the Fed has started to dial back its stimulus, many investors are yanking their cash out of emerging markets and bringing the cash back to more stable markets and economies, such as the U.S., hurting the developing nations in the process, explains Russ Koesterich, chief investment strategist at BlackRock.

"Emerging markets need the hot money but capital is exiting now," says Koesterich. "What you have is people saying, 'I don't want to own emerging markets.'"

Here’s another example. Most Americans cannot even find Liberia on a map, but right now the actions of our Federal Reserve have pushed the currency of that small nation to the very edge of collapse:

Liberia's finance minister warned against panic today after being summoned to parliament to explain a crash in the value of Liberia's currency against the US dollar.

"Let's be careful about what we say about the economy. Inflation, ladies and gentlemen, is not out of control," Amara Konneh told lawmakers, while adding that the government was "concerned" about the trend.

Closer to home, the Mexican peso has likewise been impacted.

We’ve seen this before. Here are the likely impacts on these emerging market nations if this continues:

• Looting

• Violence

• Blackouts

• Shortages of basic supplies

• Runs on the banks

Hopefully something can be done to stop this from happening. But once a bubble starts to burst, it is really difficult to try to hold it together.

And while all this is happening, what are the big movers and shakers doing?

In the last month we saw the largest withdrawal from JP Morgan's gold vault ever recorded.

What does that say to you? To me, it seems that this is a harbinger of things to come. 2014 is shaping up to be a very volatile year. I hope that you are ready for what is coming next.

No comments:

Post a Comment