I will preface Mark Hulbert’s excellent article below with some facts that are written in blue. As

holiday shoppers raided Black Friday sales and internet retailers ahead of

Christmas, the establishment media heralded a new era of economic boom for the

2013 shopping season.

Things are not as good as they seem if you follow official government

statistics and propagandized “Lame Stream Media” news reports.

In the week leading up to Christmas, for example, retail analysis firm ShopperTalk advised that brick and mortar retail

traffic was down over 20% this year.

…In-store retail sales decreased by 3.1 percent from the same week

last year. Retail brick-and-mortar shopper traffic decreased by 21.2 percent

compared to the same time period in 2012.

Some would argue that much of this foot traffic jumped to the internet

to make their holiday purchases, but according to the National Retail Federation sales online were only

slated to rise 3.9% this year, which is nothing to write home about considering

annual retail sales for the last 10 years rose an average of 3.3%.

Consumers, it seems, are starting to feel the pinch of widespread job

losses, wage reductions, cuts to government assistance and termination of unemployment benefitsfor millions.

But the cuts in consumer spending don’t just stop with traditional

American holiday staples like electronics, brand name clothing and furniture.

It is affecting all consumer markets.

The National Association of Realtors reported that the month of

September saw its single largest drop in signed home

sales in 40 months. And that wasn’t just a one-off event. In

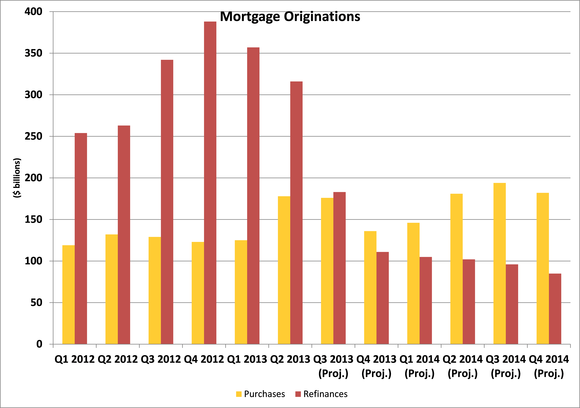

December 2013 mortgage applications collapsed a shocking 66%, hitting a 13-year

low.

Something is amiss, and despite claims of economic recovery emanating

from the “Lame Stream Media”, the numbers on Main Street, where they really

matter, suggest that we are in for a rough ride.

Eric Peters Autos, which analyzes political and economic

trends, notes that trouble is brewing all over and it may soon have an overt

impact on what many consider to be the only measure of economic health in

America: rising stock markets.

A canary may have just keeled over.

Not in the coal mine – but in the stock market.

Recently shares of Ford, the healthiest of the Big Three automakers, were

down 8 percent, according to Bloomberg. And it’s not just Ford, either.

GM, Honda and Toyota stocks were down, too.

Could it be related to the gloomy news that the number of new mortgage

applications has just hit a 13 year low? That the yield on 10-year U.S.

Treasuries is a barely break-even-with-inflation 3 percent? That there are

almost1.5 million fewer Americans employed full-time today than there were in

2006, even as the population has increased by 16 million since then?

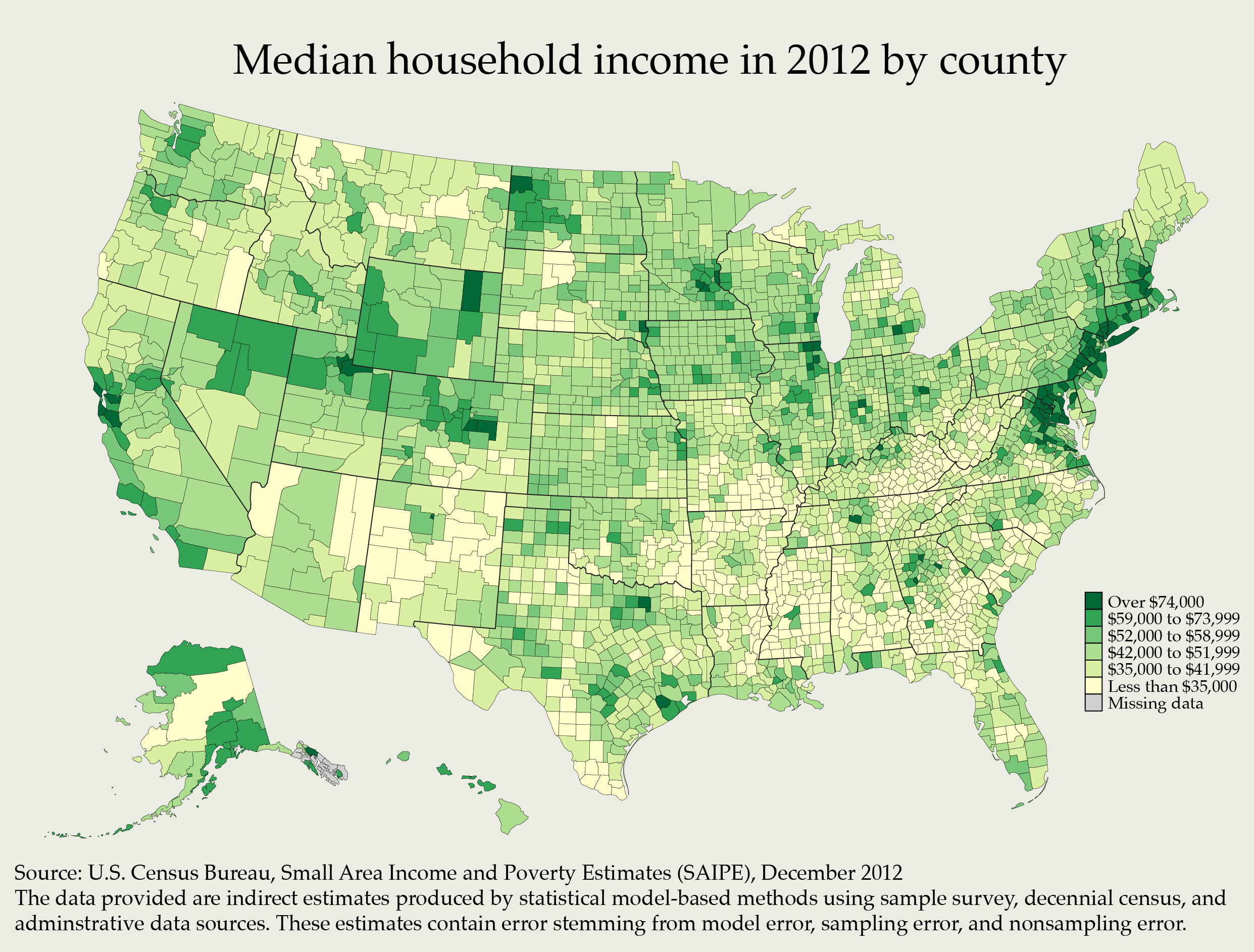

The buying power of the average

American – not just his ability but his inclination – is the decisive factor.

And the buying power of the average American is going down – not up. Lower household

income; higher cost of necessaries (food especially). Higher – and new – taxes (in particular, the

ObamaTax). The very real specter of Zimbabwean inflation at any moment. It is

enough to give a sensible person pause.

Interest rates? Forget about it.

When they begin their inevitable uptick it will be impossible to sweep under

the rug.

And it will probably do to the car industry’s fortunes what Bernie

Madoff did to his “investors.”

Grab onto something. It’s going to

get bumpy.

Any way you slice it, whether it’s car sales, home sales, retail

sales, employment, or monetary stimulus, the warnings are everywhere. The

canary in the coal mine is going into cardiac arrest.

Back in 2007 trend forecaster Gerald Celente warned the world of the “Crash of

2008.” He based his analysis on many of the aforementioned data points. We’re

seeing a similar pattern develop in late 2013, suggesting that 2014 could be the year it all goes critical:

There’s fear and hysteria running through the entire global financial

community, because as everybody knows all they did was postpone the inevitable.

I’m saying to everybody out there,

If you don’t have your money in your pocket it’s not yours.

And as for the international scene… the whole thing is collapsing.

That’s our forecast.

We are saying that by the second

quarter of 2014, we expect the bottom to fall out… or something to divert our

attention as it falls out.

The chart compares stock market behavior prior to the 1929 crash, to the same current period of time (over the latter part of 2013 to February 2014). According to this chart, another stock market crash is due in 2014 – any time as from late February to early March.

This chart and the accompanying conclusions drawn by Mark and other proponents have not been short of critics, who have for example made allegations of “retrofitting of the recent data to some past price pattern”. Proponents such as responded that since November 2013, the same pattern has nonetheless persisted and that “… there is no guarantee that the market has to continue following through with every step of the 1929 pattern. But between now and May 2014, there is plenty of reason for caution.”

Whatever the case, there appears to be general consensus that the stock market is anything but stable and healthy, and that it now appears to be just a matter of when, rather than if, it will crash to allow for the painful but inevitable natural market corrections required.

Predictions also seem to favor the likelihood that the details around the next stock market crisis would actually take more of a resemblance to the 2008 crash, as opposed to the 1929 one, although the fundamental causes and effects would be largely the same.

What would the aftermath of this expected stock market crash really look like? Kevin Freeman, a financial analyst, writes in an online publication of humanevents.com: “The fragile economic recovery process would crumble. Nearly $8 trillion of wealth would disappear. Retirement plans would collapse and unemployment would soar.”

Worse still, Kevin cites another potential trigger or additional cause to this aftermath: “….the stock market is shockingly vulnerable to a flash crash that could erase 6500 points from the Dow Jones Industrial Average. This isn’t an outlandish forecast. In fact, it is something we should be expecting… While technology played a role in the crash of 1987, its effect today will be far more severe. We’ve already experienced “flash crashes” caused by technical glitches.

No one can predict with certainty the timing of a natural market correction let alone a cyber-economic attack. But we know that enemies of the United States have been planning a cyber attack on our economy for quite some time.

And we are more vulnerable than ever before. Official Chinese military publications identify a “man-made stock market crash” as an appealing financial weapon for a new era. The deputy chief of the general staff of the Chinese army has said, “In the information era, seizing and maintaining superiority in cyberspace is more important than seizing command of the sea and air in World War II.” He’s right and he’s not alone in this knowledge.”

This information has also been separately verified by US Military Intelligence, hence this is a serious, confirmed threat requiring attention.

And as though this picture wasn’t gloomy enough, all indications are that the world is bracing itself for a “deflationary shock”. James Gruber, writing for the Asia Confidential on January 29, 2014 under the title: “Welcome to Phase Three of the Global Financial Crisis” comments: “What the eruptions of the past week really show is that the system based on easy money created by these bankers remains deeply flawed and these flaws have been exposed by moves to tighten liquidity in the U.S. and China. The system broke down in 2008, and again in Europe in 2011 and now in EM in 2013-2014”.

James concludes in his article that in his view, the most likely “end game” scenario would be that “There’s a global deflationary shock where all asset prices fall and fall hard. A la 2008. In this instance, central banks would go in all guns blazing with more money printing on an even grander scale. This would risk inflation if not hyperinflation as faith in currencies is diminished, if not lost.

Ambrose Evans-Pritchard would agree with the “global deflationary shock” outcome. He offers his detailed perspective in a discourse (World risks deflationary shock as BRICS puncture credit bubbles) published in the Telegraph on the 29th of January:

“Half the world economy is one accident away from a deflation trap. The International Monetary Fund says the probability may now be as high as 20pc. Ambrose then quotes IMF's Christine Lagarde in Davos:

"We need to be extremely vigilant," she said. "The deflation risk is what would occur if there was a shock to those economies now at low inflation rates, way below target. I don't think anyone can dispute that in the eurozone, inflation is way below target."

Ambrose aptly elaborates: “…It is not hard to imagine what that shock might be. It is already before us as Turkey, India and South Africa all slam on the brakes, forced to defend their currencies as global liquidity drains away.

The World Bank warns in its latest report - Capital Flows and Risks in Developing Countries - that the withdrawal of stimulus by the US Federal Reserve could throw a "curve ball" at the international system.

"If market reactions to tapering are precipitous, developing countries could see flows decline by as much as 80pc for several months," it said. A quarter of these economies risk a sudden stop. "While this adjustment might be short-lived, it is likely to inflict serious stresses, potentially heightening crisis risks."

The report said they may need capital controls to navigate the storm - or technically to overcome the "Impossible Trinity" of monetary autonomy, a stable exchange rate and free flows of funds. William Browder from Hermitage says that is exactly where the crisis is leading, and it will be sobering for investors to learn that their money is locked up - already the case in Cyprus, and starting in Egypt. The chain-reaction becomes self-fulfilling. "People will start asking themselves which country is next," he said.

One country after another is now having to tighten into weakness. The longer this goes on and the wider it spreads, the greater the risk that it will metamorphose into a global deflationary shock.

Those who think deflation is harmless should listen to the Bank of Japan's Haruhiko Kuroda, who has lived through 15 years of falling prices. Corporate profits dried up. Investment in technology atrophied. Innovation fizzled out. "It created a very negative mindset in Japan," he said. Japan had the highest real interest rates in the rich world, leading to a compound interest spiral as the debt burden rose on a base of shrinking nominal GDP.

Any such outcome in Europe would send Club Med (Italy, Spain, Portugal and Greece) debt trajectories through the roof. It would doom all hope of halting Europe's economic decline or reducing mass unemployment before the democracies of the afflicted countries go into seizure.”

Ambrose concludes with the question: “So why are they letting it happen?”

A pertinent question: who in the public interest would want to let a stock market crash happen, or allow global deflation to take root…if these crises can be averted partially or fully? The answer is there be a clique of powerful global elitists and satanists quietly working behind the scenes to ensure their long held ambition to introduce a “New World Economic Order” (NWO) out of the ashes of global economics and finance?

The Rapture and then the anti-christ's false security and peace may come faster than we might expect. Quite frankly we are running out of time. Have you genuinely accepted Jesus Christ as your Lord and Messiah?

No comments:

Post a Comment