The “Shemitah effect” continues in force and the various trends that we can observe in economic, political, religious and military sectors will inevitably have their day.

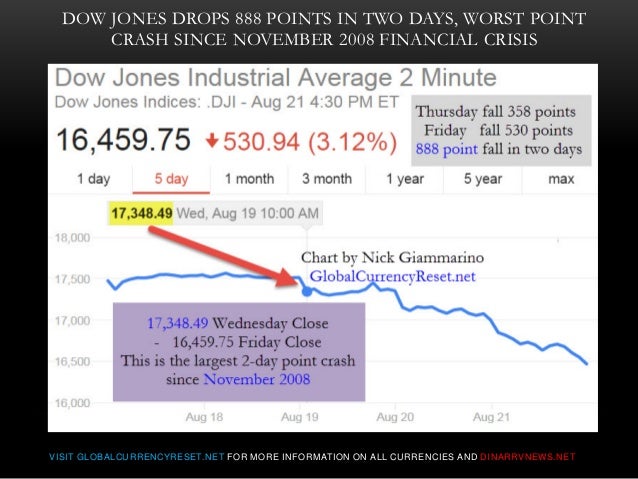

We witnessed something truly historic happen on Friday, 21 August 2015. The Dow Jones Industrial Average plummeted 530 points, and that followed a 358 point crash on Thursday the 20th. When you add those two days together, the total two day stock market crash that we just witnessed comes to a grand total of 888 points, which is larger than any one day stock market crash in U.S. history. It is also interesting to note that this 888 point crash comes in the 8th month of our calendar. Perhaps that is just a coincidence but we know our God sends us messages mathematically. I don't believe the 888 number is an accident. This was the first time that the Dow has dropped by more than 300 points on two consecutive days since November 2008, and we all remember what happened back then. Overall, it was the worst week for the Dow in four years, and there have only been five other months throughout history when the Dow has fallen by more than a thousand points (the most recent being October 2008).

Of course, with non-stop money printing (Quantitative Easing) it is still not a record in terms of percentage drop. The largest percentage drop ever in the Dow was just a few weeks after the end of the Shemitah in 1987, on Black Monday, when the markets fell “only” 508 points, but that was a drop of 22.61%. The 888 points dropped is only about 5% however many things are looking eerily like 2007/2008 right now and that includes the Dow.

Japan announced last week that the Japanese government will do currency swaps with Russia, thus deserting the U.S. dollar.

On August 6, 2015, Goldman Sachs, which has issued very bearish forecasts on long-term gold prices, took delivery of a 3.2-ton purchase of physical gold. And, on the same day, on August 6, HSBC which also claims to be bearish, took delivery of a 3.9-ton purchase of physical gold. In both cases, the purchases are registered as being for the benefit of the bank’s own house account, rather than the accounts of customers. Perhaps this is a case of watch what they do not what they say. The fact that they bought physical, as opposed to the paper gold products speaks volumes............friends, this is just another proof of the propaganda filling the financial air waves and the "lame stream media". Don't be a sheeple, stay informed, read your Bible and watch honest Christian reporters on youtube.

Money Metals Exchange, a top US national gold retailer, released a report and said the following, “We’re seeing more buying interest than at any time since the 2008 financial crisis. If we see a further spike in demand, the whole supply chain for silver could be cleaned out. In that event, customers will

face long lead times and limited product choices. Gold supply is showing some signs of strain also. According to Money Metals Exchange, demand for physical gold and silver surged 135% since June.

Commodities, see the chart above, are at their lowest level since 2000, this does not take into account Gold or Silver. There is a one very noticeable change in the last few weeks. Normally, over the last five years, when the markets and commodities went down gold would go down too. This has not happened this time around. Gold, is in demand and bottomed after hitting its high nearly four years ago above $1,800.

On August 12th, Societe Generale strategist Albert Edwards warned the China devaluation is a step toward "a financial-market rout every bit as large as 2008." Edwards continued: “We expect the acceleration of EM devaluations to send waves of deflation to the west to overwhelm already struggling corporate profitability and take us back into outright recession. As investors realize yet another recession beckons, without any normalization of either interest rates or fiscal imbalances in this cycle, expect a financial market rout every bit as large as 2008.”

The Federal Reserve has stuck with its Zero Interest Rate Policy for nearly seven years now, how do you raise rates now given all of the above? If the FED does raise rates, even 0.25%, in my opinion it could create a global financial and economic calamity. And if they keep it at 0% for the foreseeable future while the financial and economic systems collapse they will look impotent to do anything about it. The Fed is between a rock and a hard place and remember Fed policies after the 1929 crash made the Great Depression even worse.

The US Treasury debt has been “frozen” at $18,112,975,000,000 since March 13th when it last hit the debt ceiling. US Treasury Secretary Jacob Lew has been using “extraordinary measures” to hold it at that level since then. “Extraordinary measures” mostly entails accounting tricks. Interestingly, he plans to hold these extraordinary measures until October 30th… meaning yet another interesting thing happening in the September/October time period.

The Federal Reserve held its annual meeting in Jackson Hole from August 27th to 29th. It's historically the place where central bankers set the agenda for the final four months of the year. Interestingly, Janet Yellen wasn’t there. Rumors are swirling if she is on the way out to be replaced by Stanley Fischer, current vice Chair of the Fed, and dual Israeli and U.S. citizen.

The Fed still plans to meet on September 16th and 17th. An interest rate hike at that time, given the market’s current conditions, could set off a massive market plummet unseen in our lifetimes. A collapse of that size would surely cause massive unrest in the U.S. If that is the case it’d be convenient to have the U.S. military fully prepared to try to quell the unrest.

On August 19th, the International Monetary Fund (IMF) said that it will freeze its benchmark currency basket until October 2016. The IMF was expected to add the Chinese yuan to the currency basket this September but that is not going to happen.

Chinese officials have been provided with orders from high government officials that travel to the U.S. has been banned for approximately two months. That period was two month from August and September.

The Shanghai Containerized Freight Index, that key shipping freight rates for transporting containers from ports in Asia to Northern Europe fell by 26.7% to $469 per 20-foot container (TEU) in one week in late August 2015. The collapse in rates has been massive. It was the third consecutive week of falling

freight rates on the world’s busiest route and rates are now nearly 60% lower than three weeks ago. Hong Kong cargo containers dropped 9.5% year over year (YOY) and recorded its 13 consecutive months decline, worst in modern history. Singapore throughput dropped 13.2%. All these shipping statistics are the worst since, you guessed it, the 2008 crisis.

On 20 October 2015 the Fed may announce a currency alternative that would effect hundreds of billions of dollars.

Finally, on 1 September 2015 Putin eliminated the U.S. dollar and the Euro from CIF trading.

Friends, I would advise that you stock up on plenty of water, food and toilet paper for the remainder of the year but it is far more important that you spiritually prep with Yeshua!

No comments:

Post a Comment