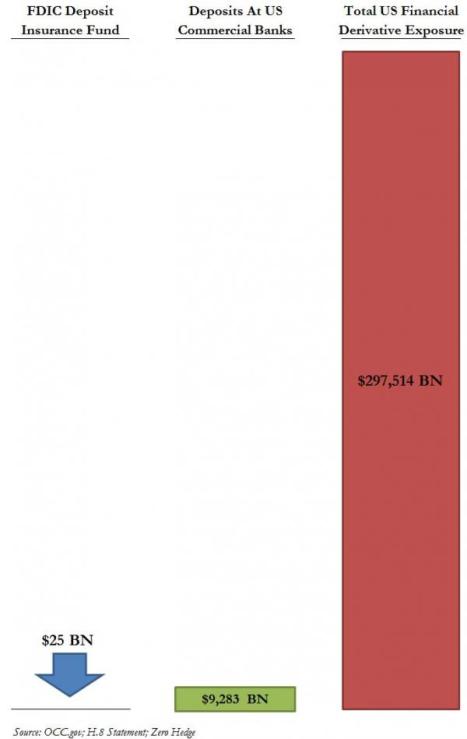

The problem with deriviatives is graphically

illustrated in this chart from a March 2013 ZeroHedge post

pictured above:

After closing their New World Order meeting in China and wearing their stupid costumes on the weekend of November 16th, the

G20 New World Order leaders whisked into Brisbane, posed for their photo ops, approved some

proposals, made a show of roundly disapproving of Russian President Vladimir

Putin, and whisked out again. It was all so fast, but they knew they were endorsing and rubber-stamping the Financial Stability Board’s

“Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in

Resolution,” which completely changes the rules of banking. Keep in mind, these global thugs make decisions that effect you and me and none of us elected these foreigners to make our decisions. I wish we would get an American President to quit going to these damn meetings that destroy U.S. sovereignty and erode our House and Senate's authority.

Russell Napier, writing in ZeroHedge termed their latest decision “the day money died.” In any case, it may have been the day deposits

died as money. Unlike coins and paper bills, which cannot be written down or

given a “haircut,” says Napier, deposits are now “just part of commercial

banks’ capital structure.” That means they can be “bailed in” or confiscated to

save the megabanks from derivative bets gone wrong.

Rather than reining in the massive

and risky derivatives casino, the new rulesprioritize the payment of banks’

derivatives obligations to each other, ahead of everyone else. That

includes not only depositors, public and private, but the pension funds that

are the target market for the latest bail-in play, called “bail-inable” bonds.

“Bail in” has been sold as avoiding

future government bailouts and eliminating too big to fail (TBTF). But it

actually institutionalizes TBTF, since the big banks are kept in business by

expropriating the funds of their creditors.

It is a neat solution for bankers and

politicians, who don’t want to have to deal with another messy banking crisis

and are happy to see it disposed of by statute. But a bail-in could have worse

consequences than a bailout for the public. If your taxes go up, you will

probably still be able to pay the bills. If your bank account or pension gets

wiped out, you could wind up in the street or sharing food with your pets.

In theory, US deposits under $250,000

are protected by federal deposit insurance; but deposit insurance funds in both

the US and Europe are woefully underfunded, particularly when derivative claims

are factored in.

The G20

agreement, that Obama participated in, was compounded by the passage of the

recent budget bill that places big bank derivatives above the average American’s

bank account.

When the “crash”

comes and it is coming, your money in the banks could be given to the big banks

in a bailout so that those banks can avoid collapsing. More likely we taxpayers will pay the bill to bail out the big banks. An $18 trillion deficit will sky rocket again. Derivatives, credit swaps and commodity trading were a major factors in the 2008 crash and they are

back bigger and worse than ever. As the graph at the top clearly shows there are now

$300 billion in derivatives (housing, oil and others) however there is only $29

in FDIC insurance for our accounts in the banks. I am not counting the $9

billion in commercial banking insurance. Friends, derivatives and credit swaps are ponzy schemes. It is like you giving the Watchman money to play the lottery. It is a house of cards waiting to fail. Also the so-called transparent Obama presidency has been exposed as a fraud, he is truly the bankster's and wall street's best friend.

Criminal bankster and JP Morgan Chase Chairman and CEO Jamie Dimon, pictured above, personally called politicians to urge support for the derivatives rule in the budget.

The acrimony that erupted Thursday between President Obama and members of his own party largely pivoted on a single item in a 1,600-page piece of legislation to keep the government funded: Should banks be allowed to make risky investments using taxpayer-backed money?

The very idea was abhorrent to many Democrats on Capitol

Hill. And some were stunned that the White House would support the bill with

that provision intact, given that it would erase a key provision of the 2010

Dodd-Frank financial reform legislation, one of Obama’s signature achievements.

But perhaps even more outrageous to Democrats was that

the language in the bill appeared to come directly from the pens of lobbyists

at the nation’s biggest banks, aides said. The provision was so important to

the profits at those companies that J.P.Morgan's chief executive Jamie Dimon (the white collar bankster criminal) himself telephoned individual lawmakers to urge them to vote for it,

according to a person familiar with the effort.

The White House, in pleading with Democrats to support

the bill, explained that it got something in return: It said that it averted

other amendments that would have undercut Dodd-Frank, protected

the Consumer Financial Protection Bureau from Republican attacks, and won

double digit increases in funds for the Securities and Exchange Commission and

the Commodity Futures Trading Commission. "The president is pleased,"

said White House spokesman Josh Earnest.

Friends, Obama is clearly in the camp of the banksters. I may be wrong but I do believe Democratic Presidents Harry Truman and Franklin Roosevelt would have never signed such a bankster budget. But it is not just the Dems, Boehner and McConnell and the Republicans are just as bad. These scoundrel politicians sold the average American out for future campaign funds from the big banks.

Earnest said that Democrats were upset about "a specific

provision in this omnibus that would be related to watering down one provision

of the Wall Street reform law. The President does not support that

provision. But on balance, the President does believe that this

compromise proposal is worthy of his support."

But "that provision" isn't just any provision.

It's one that goes to the heart of the Dodd Frank reform because it would let

big banks undertake risky activities with funds guaranteed by the federal

government and, hence taxpayers.

The omnibus appropriations bill would do that by undoing

the Dodd Frank provision that ordered banks to move their riskiest activities

-- such as default swaps, trading commodities, and trading derivatives -- to

new entities so that deposits guaranteed by the Federal Deposit Insurance Corp.

would not be in danger.

House Minority Leader Nancy Pelosi (D-Calif.) pointed to

this item as the main reason she would vote against a bill backed by her own

president. Wow, this is a rare moment when I agree with Pelosi.

"What I am saying is: the taxpayer should not assume

the risk," she said. She said the amendment went "back to the same

old Republican formula: privatize the gain, nationalize the risk. You

succeed, it's in your pocket. You fail, the taxpayer pays the bill.

It’s just not right."

It isn't only liberal congressional Democrats up in arms

about the proposed change. "It really is outrageous," said a former

senior Obama Treasury official, who asked for anonymity to preserve business

relationships. "This was the epicenter of the crisis. This is what brought

AIG down, what brought Lehman Brothers down."

The nation's biggest banks -- led by Citigroup, J.P.

Morgan and Bank of America -- have been lobbying for the change in Dodd Frank,

which had given them a period of years to comply. Trade associations

representing banks, the Financial Services Roundtable and the American Bankers

Association, emphasized that regional banks are supportive of the change as

well. I do not believe the small bankers support this change. I think this a blatant lie.

The banks have long argued that the Dodd Frank provision

will limit their ability to extend credit to clients and that setting up

separate entities to engage in derivatives and commodities trading isn't

practical. The ABA’s top lobbyist, James Ballentine, executive vice president

of congressional relations and political affairs, said in an e-mailed statement

that the requirement that banks move some swaps in to separate affiliates

"makes one stop shopping impossible for businesses ranging from family

farms to energy companies that want to hedge against commodity price

changes."

But the regulatory change could also boost the profits of

major banks, which is why they are pushing so hard for passage, said Simon

Johnson, former chief economist of the International Monetary Fund and a

professor at the MIT Sloan School of Management.

"It is because there is a lot of money at

stake," Johnson said. "They want to be able to take big risks where

they get the upside and the taxpayer gets the potential downside," he

said.

Johnson said the amendment of Dodd Frank only affects a

small portion of derivatives. “I don’t want to make a mountain out of a

molehill on this,” he said. But he added that “on a forward looking basis this

could become very big.”

The effort to enact this language has been years in the

making. Language that was written and edited in part by the major banks was

originally inserted in a House bill that called for relaxation of the push out

rules in 2013. Citi Bank declined to comment on the role its lobbyists played in

developing the legislation, which was originally disclosed in an e-mail

exchange reported on by the New York Times. However, a blog post written in

2013 by the bank’s head of global public affairs, referred to the effort to

modify this portion of Dodd-Frank as “a great example of how the industry and

Congress can work together to find common ground.”

The banking lobby has always been a powerful force in

Washington. The banks that could benefit from this change -- Citigroup and J.P.

Morgan -- are among Washington’s most influential corporate players. Each firm,

for example, spent over $5 million a year lobbying in recent years, both of

them ranking in the top 90 firms for lobbying expenditures, according to data

prepared by the Center for Responsive Politics. In addition J.P. Morgan

contributed over $5 million to federal candidates and parties in 2012, compared

with $2.6 million in the last election cycle for Citigroup. And both

firms have strong connections on Capitol Hill and the White House. Citi, for

example, includes among its stable of lobbyists former House Speaker Bob

Livingston (R-La.) and former Senators John Breaux (D-La.) and Trent Lott

(R-Miss.).

Former House Financial Services Committee Chairman Barney

Frank on Wednesday also urged his former colleagues to reject the omnibus

appropriations bill. He called the amendment inserted into the bill “a

substantive mistake, a terrible violation of the procedure that should be

followed on this complex and important subject, and a frightening precedent

that provides a road map for further attacks on our protection against

financial instability."

Frank added that “ironically it was a similar unrelated

rider put without debate into a larger bill that played a major role in

allowing irresponsible, unregulated derivative transactions to contribute to

the crisis." He said people could disagree about how best to regulate derivatives

but that the way to do that was "not for a non-germane amendment inserted

with no hearings, no chance for further modification, and no chance for debate

into a mammoth bill in the last days of a lame-duck Congress."

The Senate passed the budget 56 to 40 with 4 missing votes.

The House passed the budget 219 to 206. 67 Republicans voted against the budget. 57 Dem traitors voted with 162 Republican traitors.

No comments:

Post a Comment