First, Trump is the new Andy Jackson. Jackson paid off the U.S. debt and he hated "bank money" and private centralized banks.

By the way, the last U.S. President who tried "state money" was John F. Kennedy and the banksters helped kill him on Nov. 22, 1963 in my opinion.

So how could Donald Trump pay off the national debt in just 8 short years as he promised to do during his interview with Washington Post last Thursday? Click the video link below to see.

First you have to understand what the National Debt is.

When Congress wants to spend more money than it has in income, that’s called a budget deficit. So let’s say that in 2015, the budget passed by Congress was $4 trillion, but the national income – the total revenue was only 3.5 trillion. Then there is a 500 billion dollar budget deficit. So where does the nation get the extra money?

The Treasury has to borrow it. Who do they borrow it from? Mostly banks, but most of the debt is auctioned off so that the Treasury can get the best price.

There are many different financial products the Treasury sells to raise money - Treasury bonds, Treasury Notes, Treasury Bills and other products – each have slightly different attributes and maturity dates.

The long-term 10 and 30-year bonds bring the highest interest rates. The short-term Treasury bills bring the smallest rates of interest.

For example, here is a results sheet for a March 28 sale of 91-day Treasury Bills. They sold for interest rates of between .25% and .3%. Their maturity date is June 30, 2016. That’s when you can cash them in and get back your principle and interest.

Here is a results sheet for 4-week Treasury bills. They were sold at between .1% and .2% interest rate.

Now let’s go all the way up the scale to the 30-year bonds. These were sold 3 weeks ago and were bought at a rate of between about 2.6% and 2.7%, but they mature in 2046.

The United States has never defaulted – that is, failed to pay – on its bond repayments. Therefore, U.S. Treasury securities are considered the world’s safest investments.

These various Treasury securities pile up the National Debt. Here is our current national debt to the penny: 19 trillion, 264 billion, 938 million, 619 thousand and 643.07 as of March 31 – last Tuesday.

How much interest are we paying on all this borrowing. Well, it varies wildly from year to year, but here are the last 5 years. It has varied from about 360 billion dollars to 454 billion dollars.That’s almost as much as we spend on the Defense Department! It is as much as we currently spend on Education, Medicare & Health, Veterans Benefits, HUD, International Affairs, Energy & Environment, Science, Social Security, Unemployment & Labor, Transportation and Food & Agriculture.

How about some projections into the future of the national debt? Pretty much worthless. In 2000, the Congressional Budget Office created this graph. It showed that the debt-to-GDP ratio of the U.S. wouldn’t go over 100% until about 2035. Well guess what, it hit 100% in 2015 – twenty years ahead of schedule. In 2009, the CBO made another projection – 100% debt-to-GDP ratio was moved up to about 2024. Again, we hit it in 2015 – 9 years ahead of schedule.

All we can say is that since President Obama took office, the debt has more that doubled from about 9 trillion to its current 19 trillion.

Since interest rates can’t go any lower, it’s fair to say that interest rates have to move higher, at some point. And that means that the best-case scenario for the future is that the national debt will DOUBLE every 5 to 7 years – unless something is done.

Obviously, this is not sustainable. Eventually, just the interest payments on the debt would consume our entire federal budget.

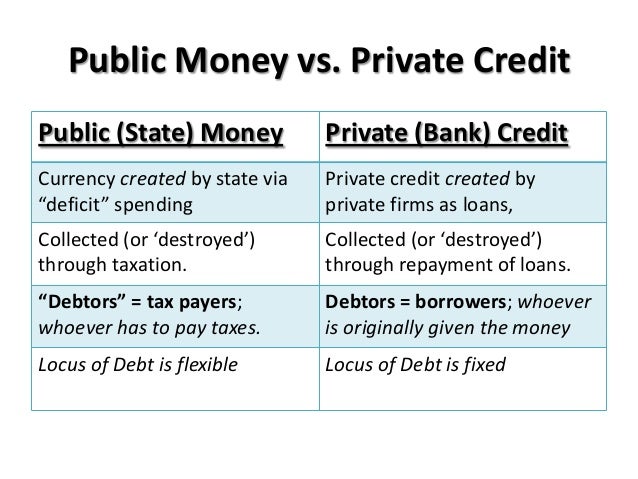

There is one way to tackle this problem. Get out of this debt money system where banks create all the money in the system by having the outrageous privilege of lending money they don’t have. It’s not a new concept. To economic historians it’s known as a “bank money” system.

Bank money systems tend to breed an oligarchy as most of the big money is naturally sucked up by the banking system.

The opposite of a Bank Money system is a State Money (shown below, notice red seal) system. State Money is money created by the Treasury for the benefit of all citizens equally – not favoring one class – the banking class. Therefore a State Money system tends to reduce the amount of money the banking class accumulates and creates a more wealthy middle class because the politicians pay less attention to bankers and more attention to the people.

A State Money system then sells the nations’ money to the banking class to lend out to us. It doesn’t kill the banks, it just creates real competition between them.

President John Adams considered any private issue of money a monstrosity and a fraud on the public.

https://www.youtube.com/watch?v=qOR4OiRjHA8

No comments:

Post a Comment