When a nation fails to repent God will allow an enemy to breach its defenses. I believe the event on the NY stock exchange was another breach of our defenses. Friends, hold on to your hats as we approach the following dates:

12 July Israel's Temple Institute to make a major announcment

12 July Israel's Temple Institute to make a major announcment

25-26 July 9th and 10th of Av

13 September 2015 "wipeout date" peak of Shemitah

13 September 2015 partial solar eclipse - warning to the world

14 July to 15 September Jade Helm military exercise

23 September/10 Tishrei, Yom Kippur - the crucial year of the Jubilee begins

17 Isaiah prophecy occurring as I write

September UN votes on a Palestinian state

20 September World Council of Churches marches against Israel

24 September Pope addresses U.S. Congress

25 September Pope addresses UN General Assembly

September UN votes on a Palestinian state

20 September World Council of Churches marches against Israel

24 September Pope addresses U.S. Congress

25 September Pope addresses UN General Assembly

27 September/14 Tishrei @ sunset Feast of Tabernacles begins

28 September last blood moon and total lunar eclipse of the current tetrad - a warning to the nation of Israel and the Jewish people.

13 May 2014 French foreign minister Fabius said "We are on the edge of a climatic abyss." "We have 500 days until climate chaos occurs.

24 September/11 Tishrei 2015 Fabius' climate date

15 to 28 September asteroid UR116 will pass or hit the Earth

China’s

stock exchange regulator has imposed severe limits on stock market selling,

having earlier warned of panic in the market as a range of recent government measures failed to

prevent stocks plummeting a further 6%.

After 10 minutes of morning trading a wave of

listed companies’ shares had been suspended across China’s two stock markets

after they dropped by the daily limit of 10%.

The China Securities

Regulatory Commission ruled that controlling shareholders and managers holding

more than 5% of a company’s shares could not reduce their holdings for six

months, in an attempt to maintain stability in the markets.

Earlier, the regulator’s statement saying there

had been a surge in “irrational selling” and “panic sentiment” had done little

to calm investor nerves.

The Shanghai composite index closed down 5.9%, while the SCI 300

index of the biggest listed companies in Shanghai and Shenzhen lost 6.8%.

The rout

spread to other world stock markets, with Hong Kong’s Hang Seng index closing

almost 6% down, its biggest one-day drop for nearly seven years.

Since

their June peak, Shanghai stocks have plunged 30% in the space of three weeks,

having soared more than 150% in the previous 12 months as millions of -private

investors piled in.

“It’s a stampede,” said Wang Feng, a former Wall Street trader who founded the

hedge fund firm Alpha Squared Capital. “And the problem of the market is that

all the players move in the same direction and are too emotional.”

About 1,400 companies, or more than

half of those listed in Shanghai and Shenzhen – filed for a trading halt on

Tuesday in an attempt to prevent further losses.

Chen Jiahe, chief strategic analyst at Cinda Securities, said this suspension

was likely to last until the market was stabilised and liquidity was returned

to the market.

Christopher Balding, professor of economics at

Peking University, said it was not possible to know exactly why so many

companies had suspended trading, but that a large number were doing so because they had used their

own stock as collateral for loans and wanted to “lock in the value for the

collateral”.

Unlike

most other stock markets, where most investors are institutional, in China 80%

are small retail investors.

Balding said this was raising concerns of “political risk” in Beijing. With

large numbers of private investors losing a lot of money, the government would

be worried about “people protesting on the streets”.

As

part of the attempt to prevent further losses, China’s state asset regulator had already ordered

state-owned enterprises not to sell shares of their listed companies.

The People’s Bank of China said it was

assisting the China Securities Finance Corporation (CSFC), the national margin

trading service provider – which helps brokers lend money to institutions to

buy shares – to help steady the market.

It said it would do this through measures such

as aiding interbank lending. It would keep a close watch on the market,

continue to support the CSFC and guard against systematic and financial risks.

The CSFC said it would buy more shares of small

and medium-sized companies, which have suffered the biggest losses.

Chen said: “The market is panicking and the government is

trying to save it, so we are having something like a conflict between the two

powers and we are not sure which will be the strongest.”

Ayako Sera, a senior market economist at

Sumitomo Mitsui Trust Bank in Tokyo, said: “Today is all about China, with

Greece in the background … Shanghai’s

early losses were like a cliff dive, which had a huge impact on investor

sentiment.”

The continued sell-offs came after a surprise

interest rate cut by the central bank at the end of June. Relaxations in margin

trading and other “stability measures” have done little to calm investors.

Analysts said they expected the falls to continue.

“I don’t see it getting better,” Balding said.

“There is not going to be a turn around within the next week or two. It

probably has a long way to go.”

A professor of economics at

Peking University, said it was not possible to know exactly why so many

companies had suspended trading, but that a large number were doing so because they had used their

own stock as collateral for loans and wanted to “lock in the value for the

collateral”.

Unlike most other stock markets, where most investors are institutional, in China 80% are small retail investors. Balding said this was raising concerns of “political risk” in Beijing. With large numbers of private investors losing a lot of money, the government would be worried about “people protesting on the streets”.

Unlike most other stock markets, where most investors are institutional, in China 80% are small retail investors. Balding said this was raising concerns of “political risk” in Beijing. With large numbers of private investors losing a lot of money, the government would be worried about “people protesting on the streets”.

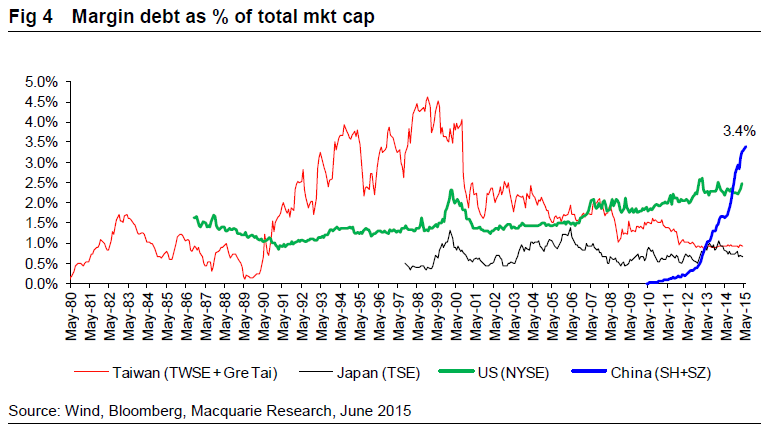

Margin debt in China has been on a tear as the Shanghai Composite Index surged nearly 130 percent this year.

With that, margin trading has jumped thirty fold over the past three years on the city’s stock exchange, as investors borrowed money to buy securities.

But when the index fell 13 percent last week, so did margin debt. Also adding to the decline has been increasing pressure from Chinese regulators.

The analysts have been tracking China's outstanding margin debt for some time. They reckon that Chinese margin debt has risen 123 percent year-to-date, reaching a new record of 2.3 trillion yuan ($370 billion) on June 18.

The team has updated its charts, which continue to show the staggering increase over the past couple of years. Here are two that stood out:

The first is margin debt as a percentage of total market value of Chinese stocks.

No comments:

Post a Comment